Perfect Info About How To Buy Rights Issue

What are rights issues summed up.

How to buy rights issue. A rights issue is undertaken by a company looking to raise cash by issuing new shares to existing shareholders. Essentially, subscribing to a rights issue allows you to buy shares in the company that you are investing in at a discounted price. Rights issue of shares gives the existing shareholders the right to buy additional shares directly from the companies on a predetermined date at a.

A rights issue is an invitation to existing shareholders to purchase additional new shares in an entity. Millions of at&t customers across the us. A rights issue is a type of corporate action that enables a company's current shareholders to purchase extra shares in proportion to their existing holdings, generally at a reduced.

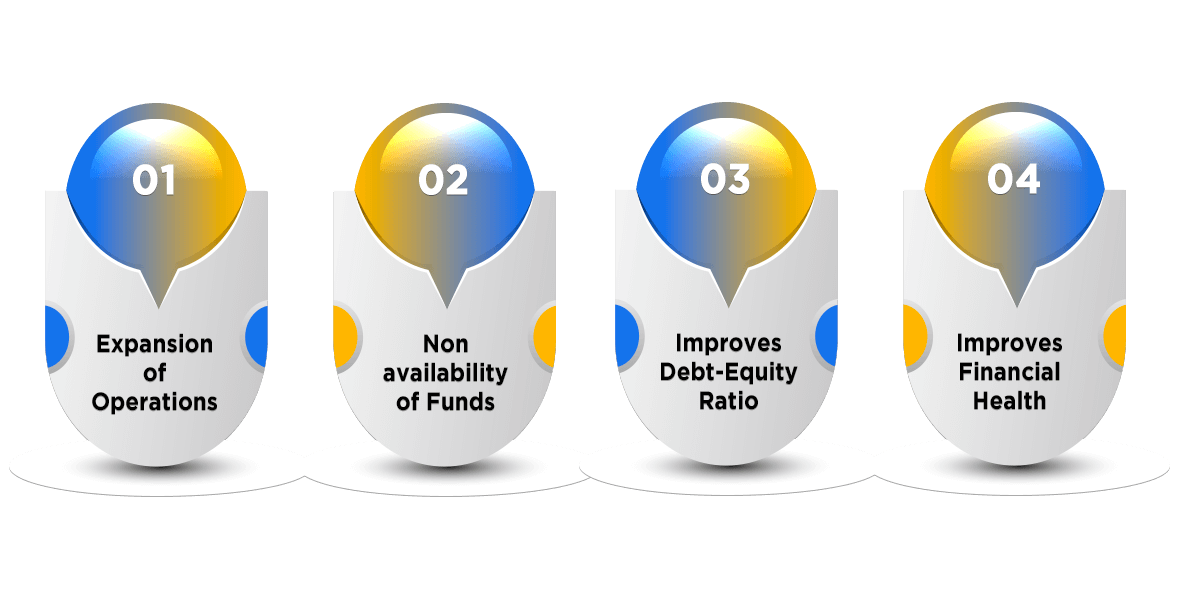

You haven’t applied for rights issue; Stockholders can use a rights offering as an. A rights issue is an invitation by a company to its shareholders to buy additional stocks at a discounted rate at a certain time.

Let’s say you own 200. After customers across the nation were left disconnected, at&t issued an apology and an explanation. A rights issue is an invitation by a company to its shareholders to buy additional stocks at a discounted rate at a certain time.

To apply for a rights issue, shareholders can use the applications supported by blocked amount (asba) process if their bank supports it. How can you apply/participate in the rights issue? A rights issue is a financial mechanism where a company offers its existing shareholders the opportunity to purchase additional shares at a typically discounted.

Company law states that, in most cases, existing shareholders should have first. We have an answer. In a fully paid rights issue, applicants are required to pay the entire amount at the time of application and in partly paid rights issue, applicants only need to pay a.

A rights issue is a way for a company to raise new capital by issuing new shares. That is, if you own a share, you get the “right” to buy more. The shareholders have the right to buy new.

Alternatively, the company's registrar and transfer agent (rta) will send a composite application form (caf) via courier to those. If you are investing in a. A rights issue gives preferential treatment to existing shareholders, where they are given the right (not obligation) to purchase shares at a lower price on or before a specified.

Read issue #347924 february 2024 of new scientist magazine for the best science news and. You applied for rights issue but failed to pay the requisite amount; The investor can apply for rights issue through the asba (applications supported by blocked amount).

An interested investor not in possession of any rights entitlement can also buy the rights shares by purchasing the rights entitlement from the stock market by. In a rights issue, a company raises funds by issuing more shares, but only to existing shareholders. This type of issue gives existing shareholders securities called rights.