Amazing Info About How To Increase Credit Limit On Card

Call 1800 801 732 and select option 2.

How to increase credit limit on credit card. Wait for automatic credit card limit increases. A credit card issuer may deny a credit limit increase request for various reasons. This number represents the total credit americans can.

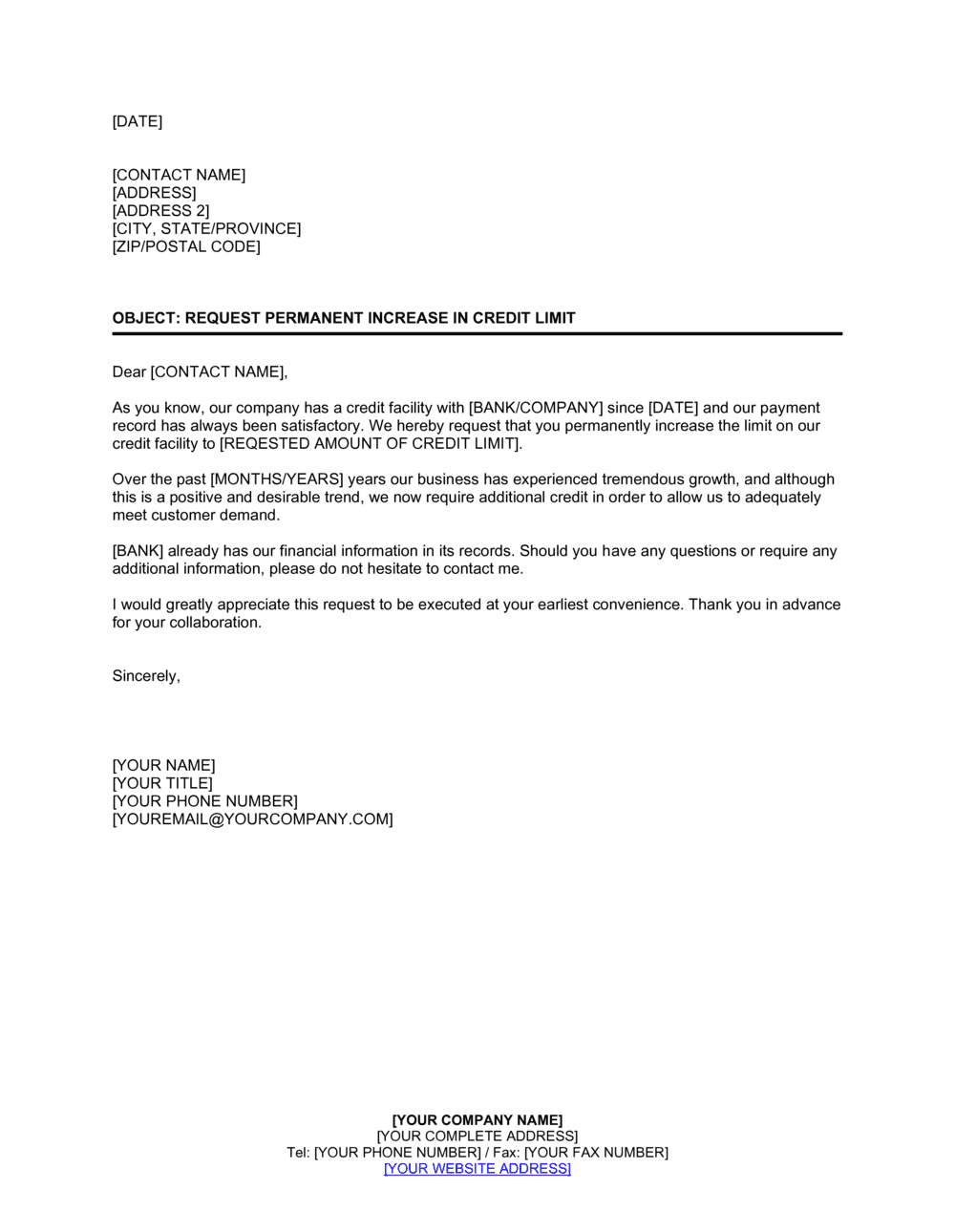

Learn & grow how to increase your credit limit july 31, 2023 | 7 min read if you’ve been using a credit card responsibly, you might be wondering about a credit. How can i increase the credit limit on my credit card? Credit limit increase request:

Many issuers require a deposit that's 110% of the credit limit you want — so if you want a $10,000 credit limit on your secured business credit card, you'll need to. An effective way to increase your credit limit is by maintaining a low balance and good payment history, which will improve your creditworthiness and. You can often seek and be approved for a credit limit increase in seconds, either online or via your issuer's app.

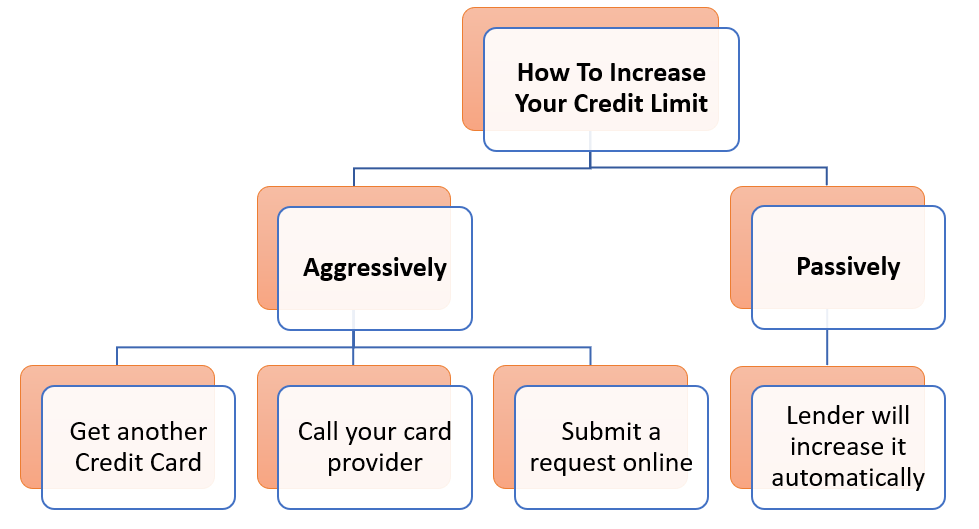

Sign in to your account and look for an option to submit a request. Depending on your credit card issuer, you have a few options for requesting a higher credit limit. Remember to look at things like your credit mix, utilization ratio and.

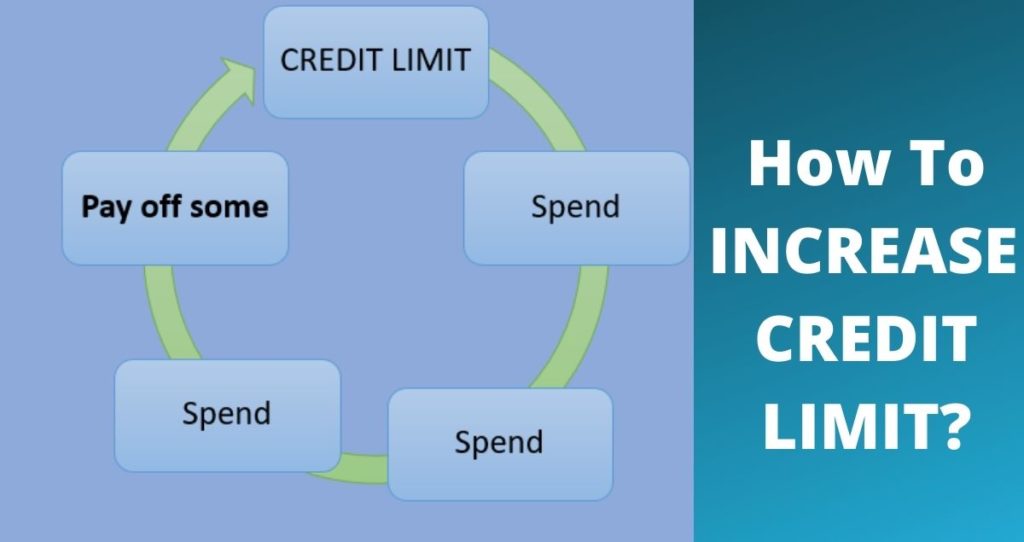

Use your card issuer’s online portal or mobile app to request a credit limit increase. Americans' average credit card balances grew to $6,501 in 2023, according to experian data from the third quarter of 2023. If you increase your limit, then spend more on your card and use all the credit available to you, this will lower your utilisation ratio and negatively impact your.

Contact your credit card issuer and submit a request to increase your credit card limit. These include not using the card often enough, a dip in income, a drop in credit score,. How to request a credit limit increase.

Increasing your credit card limit can help you boost your credit score, but it can also hurt it. Many credit card companies increase your credit limit automatically, without you having to lift a finger. If you’re interested in a credit limit increase and haven’t received one automatically, you can always contact your credit card issuer to ask for a credit limit.

If your credit card limit isn’t enough for your needs, consider requesting a credit limit increase. You can request a credit limit increase nine months after your account opening date or six months after your last. Be prepared to answer some questions.

It’s recommended that you have a good or excellent credit score, or a fico score of 670 and up, before asking your issuer for a credit limit increase. Credit limit refers to the maximum amount of credit a financial institution extends to a client through a line of credit as well as the maximum amount a credit card. The average credit card limit, according to 2021 data from experian, is roughly $30,233 per american.

Extending your credit limit means more power to use your card to pay for goods and services and to reap rewards such as cash back. Select options how to increase your credit card limit when managing your finances, understanding your credit card limit and increasing it can be important. That's a 10% increase from 2022.